Summary

GE Vernova GEV 0.00%↑ is the mother of all idiosyncratic and thematic ideas. I see a path for revenue to compound at >6% over the next 5 years and EBITDA margins to go from 3% to 10-11% in 2028. Applying a reasonable multiple to each business segment respectively implies a ~$290 stock by EOY 2027 (19% IRR). I believe the stock should continue compounding towards my PT as the company continues to execute on higher margin backlog orders, buoyed by an improving macro environment and strengthening underlying demand for the main Power and Electrification businesses. The stock already has a consensus buy rating but should see more upward revisions as the company continues to exceed expectations, eventually drawing in long-term capital allocators from LOs and SWFs.

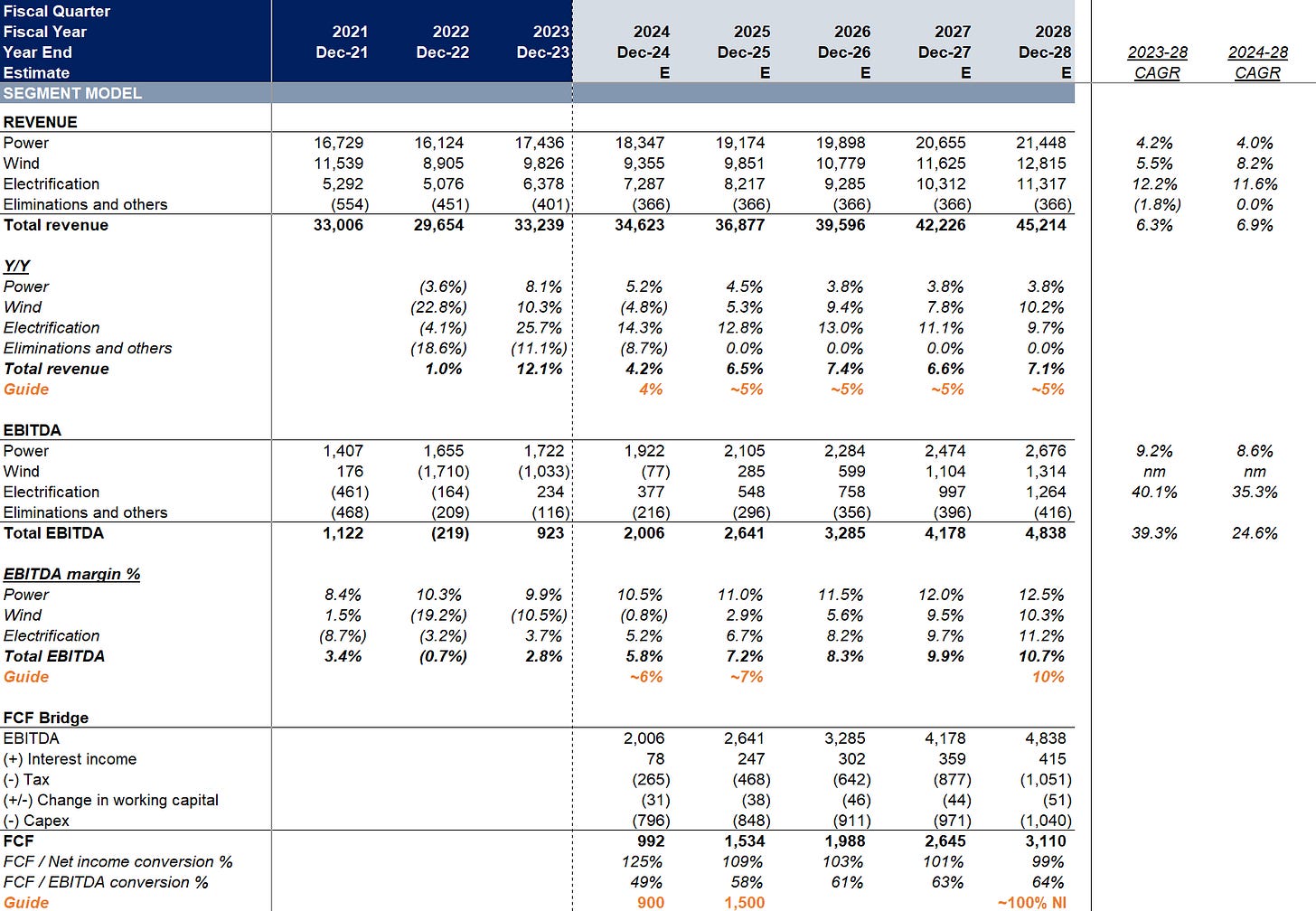

Below is an overview of my financial projections.

Introduction

GE Vernova (GEV) is the mother of all idiosyncratic and thematic ideas. Not only is it a key beneficiary of many long-term secular themes that the market loves (Decarbonization, Electrification), but it is also in the midst of a business transformation that could drive meaningful margin expansion.

This post mainly aims to (1) provide a brief overview of each business segment and the main narratives behind them; and (2) frame GEV’s valuation to illustrate why I find it interesting. For those wishing for a comprehensive overview of the product portfolio and basic details such as TAM, JPM’s initiation and the investor day webcast / transcript would be great resources.

Business description

GEV is a global leader in the electric power industry, with products and services that generate, transfer, orchestrate, convert, and store electricity. In other words, it provides the world with the core industrial components of electricity generation plants and power grids. It operates via 3 main segments: Power, Wind and Electrification which account for 53%, 30% and 19% of total revenue respectively with 2% of intersegment eliminations.

From a thematic perspective, GEV lies at the intersection of Decarbonization & Electrification themes with its installed base of turbines generating ~30% of the world’s electricity. The IEA expects demand for electricity generation in 2040 to grow by >55% from 2022 levels with natural gas and renewable sources playing a key role. This would imply that capacity investment made over the next 20 years will be double the investment made over the last 40 years. Growth will largely be driven by the myriad of regulatory tailwinds globally, most notably the US IRA and EU Green Deal.

Power — at the heart of business transformation

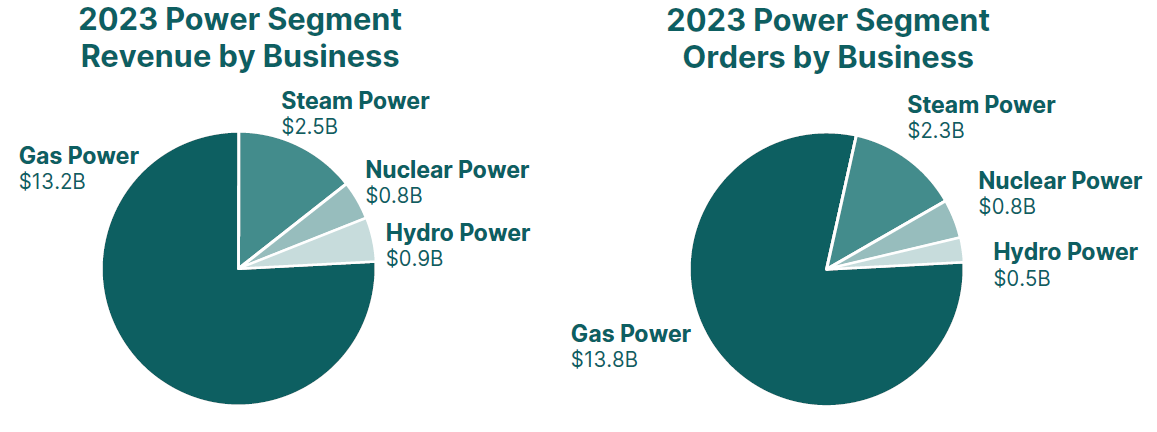

Power is the core of the business, accounting for 53% / 187% of consolidated revenues / EBITDA, with a large proportion of revenue from its high-margin recurring revenue service contracts. The Power business operates on a razor-razorblade model where GEV sells turbines used in power generation plants (32% of Power revenue) which are bundled with highly visible service revenues over the life of power generation plants (often about 20-30 years). Service revenue makes up 68% of Power revenue, with the average remaining length of >70% of existing long-term service agreements being >10 years (with ~70% renewal rates). GEV currently has the largest installed base of gas turbines globally with 886GW installed (~50% global share). Overall, GEV has an installed base of 2,206GW across gas, nuclear, hydro and steam power businesses globally (or >7,000 turbines vs ~4,000 in 2018). Given the recent interest in nuclear power, it is worth highlighting that GEV is also a global leader in steam turbines (nuclear) accounting for ~47% of global capacity in 2022.

The Power segment is further split into sub-segments based on power generation technology (gas, hydro, nuclear, steam). Gas is by far the largest sub-segment and a key driver, making up 80% of Power revenues.

The Power segment’s past failure was at the heart of GE’s downfall in the late 2010s. The tumultuous history began after a poorly-timed acquisition of Alstom’s (a French gas turbine company) energy and power assets for $13bn. The announcement came just before the ratification of the Paris Agreement, when climate policy was undergoing a monumental shift globally. Meanwhile, the rapidly declining levelized cost of electricity (LCOE) for renewable technologies exacerbated the already bleak demand outlook. These factors combined prompted utilities and developers to go into “wait-and-see” mode as they are unwilling to lock in long-term gas projects. Eventually, GE decided to exit the JVs in 2018, resulting in a huge impairment loss of $21bn+ which caused Power EBIT to plummet.

The business has turned around since its troughs in 2018, supported by an all-familiar playbook of lean manufacturing and business simplification. EBIT went from -$0.8bn to $1.2bn in 2023. GE Power was bleeding $2bn in cash a year in 2018, turned cash flow positive in 2020 and is now generating >$2bn in FCF.

Moving forward, natural gas is not a secular growth story. However, the recent energy crisis caused by Russia’s invasion of Ukraine has highlighted natural gas’ crucial role in supporting our energy transition. According to the Oxford Institute for Energy Studies, global natural gas demand is expected to grow ~10% through 2030 (~1% CAGR) — China and the Middle East are expected to account for >80% of that growth. A low-growth market deters significant competition, allowing GEV to (1) capture most of the remaining demand and (2) have pricing power. Meanwhile, the long tail of service revenues provides stable cash flow generation in the long term.

Simultaneously, GEV is also future-proofing the business with investments in decarbonized solutions which should mitigate terminal value risk in the long term (e.g., hydrogen). GEV noted significant interest in upgrades for hydrogen capabilities and the company plans to equip 100% of its power portfolio as hydrogen-ready by 2030. In addition, its aeroderivative portfolio is also versatile as it can be installed in conjunction with other renewable generation plants to serve as a “ramp solution” for zero carbon cost of power (a quick primer here).

Electrification — exciting (in the money) call option

Electrification is the smallest segment of the three but presents the greatest upside in the long term. This segment mainly includes products and solutions which facilitate power transmission and distribution. It is further categorized into 4 main sub-segments: Grid Solutions, Power Conversion, Electrification Software and Solar & Storage Solutions which account for 62%, 16% 14% and 8% respectively. This segment mainly comprises of equipment sales.

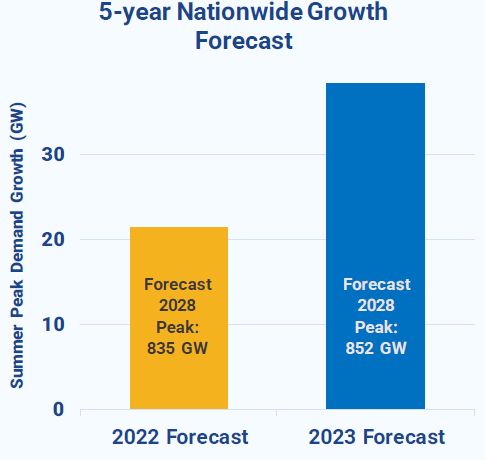

Overall, electricity demand forecasts spiked from 2.6% to 4.7% growth over the next five years as a result of greater reshoring, AI DC buildouts and broader electrification themes. US grid planners are now forecasting 38GW of growth through 2028 (or an increase of 17GW). For context, to generate 17GW, we would require 40 combined cycle gas power plants (~$20bn capex); or 2,800 onshore wind turbines ($29bn); or 8 new nuclear reactors ($114bn). However, the US electrical grid is unprepared for significant load growth. The US installed 1,700 miles of new high-voltage transmission miles per year on average in the first half of the 2010s but dropped to only 645 miles per year on average in the second half of the decade. In fact, >70% of US electrical grid is >25 years old (most were built in the 1960s and 1970s) and approaching the end of their 50-80 year cycle. Frequent extreme weather is also exacerbating the problem. Finally, long interconnection queues have resulted in a key bottleneck, effectively setting the stage for multi-year, accelerated growth for grid investment capex.

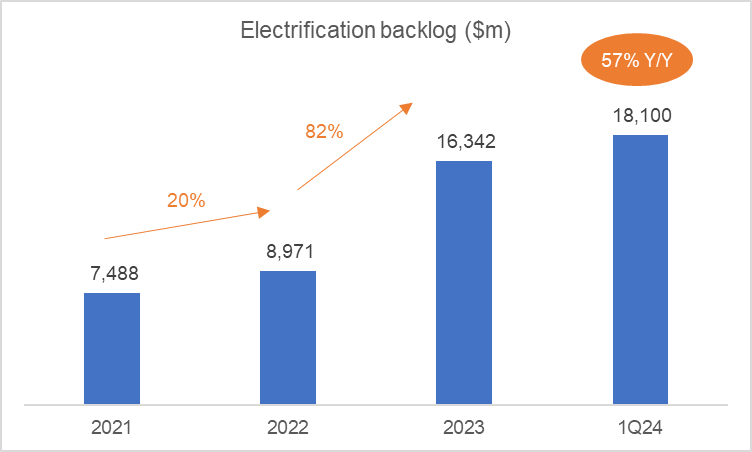

GEV has a comprehensive suite of solutions across the value chain to catch this massive investment wave. The focus is likely to be on (1) HVDC (high-voltage direct current) orders and (2) Electrification Software. HVDCs (this video is a good primer) have gained popularity in recent years as they are essentially more efficient power transmission lines compared to the large pylons we commonly see today. GEV estimates this market to grow at 35% CAGR through 2025, and I believe solid DD growth is possible through the decade given its long-cycle nature. Intuitively, HVDC is a high barrier to entry market where scale and customer relationships matter most — GEV is certainly well-positioned here. Most importantly, we are already seeing demand inflection in GEV’s backlog.

Margins remain low at 4% but only because GEV is still executing on poor margin orders made in the past. Management is already expecting HSD margins for 2024, implying the business is starting to execute on higher DD margin orders in the backlog. Considering this is a long-cycle business with a massive and growing backlog, I am confident that the margin trajectory remains healthy.

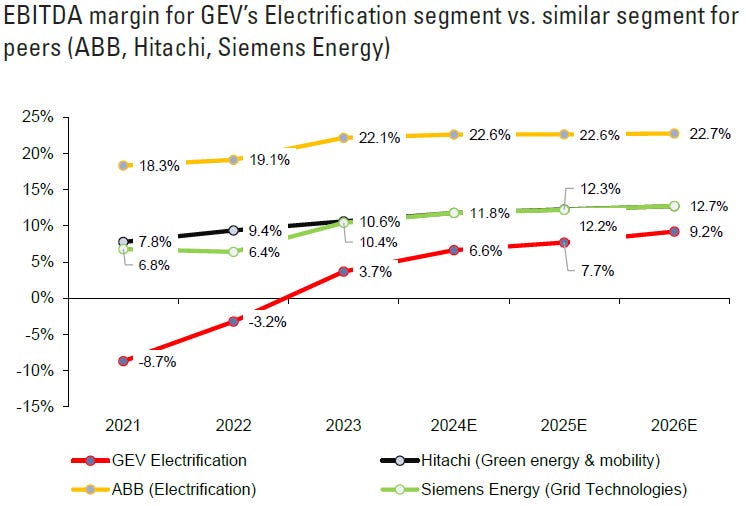

Though Electrification orders are heavily weighted in Europe for now, the management sees very strong opportunities for growth in the US where demand is skyrocketing. In fact, I believe demand in Europe is not half as bad relative to the US as more DCs are being built and grid networks are almost just as old. Referencing global peers, GEV is significantly under-earning in this segment and has significant headroom for margin expansion.

1Q24 earnings:

“We expect to see revenues in onshore wind be measurably higher in the second half than we're seeing in the first half of the year. That will contribute to improved productivity because as we said, we're anticipating onshore wind to be more at a high single digits EBITDA margin business for 2024 in totality.”

Wind — under-earning with significant upside

Wind is probably the most disliked segment of the three, underscored by an unattractive market crushed by higher rates. This segment mainly consists of wind turbine sales (Onshore being the majority) and some wind blade sales (LM Wind). Wind makes up 30% of total revenue, but has been immensely unprofitable due to several factors weighing on the wind industry for years.

The wind industry has enjoyed rapid technological innovation in the past as wind power is based on fairly straightforward power generation technology which is simplified into a single formula:

where ρ refers to Betz’s limit and E refers to the efficiency of the turbine.

Clearly, the blades’ surface area is the most direct lever of efficiency improvement, thereby nudging OEMs to expand product portfolios and engineer longer blades and taller towers. While this benefited developers, rapid innovation resulted in price wars, and manufacturing and supply chain issues for many OEMs. Finally, Covid exacerbated these issues while higher rates resulted in significant project delays.

The good news is that we are likely at a pivotal point. Product innovation is reaching its limit as the size of wind turbines is nearing the size constraints imposed by road transport and cranes. And secondly, while offshore wind turbines still have more room for size increases, innovation will increasingly decelerate in the long-term as wind turbine efficiency nears Betz’s limit. These factors combined result in diminishing incentives for OEMs to lower prices and drive volume to lower LCOE for wind energy. Taking a step back, we can see that the Wind industry has an attractive structure, with ~2-3 dominant players in each geography (with GE dominating the US onshore wind market). Industry rationalization through self-discipline and / or the natural progression of production innovation cycles should drive meaningful improvement in the pricing structure and therefore margin.

Specific to GEV, the company is also streamlining its product portfolio by reducing the number of product variants. This significantly simplifies manufacturing lines and eases supply chain issues which were key issues in the past. In addition, GEV is pulling out of long-term service contracts for wind farms to focus on equipment manufacturing. While seemingly unintuitive, I believe this is a wise choice as developers are increasingly insourcing repair and maintenance services, and independent service providers (ISPs) are growing in scale. GEV has also been very clear that they are pursuing selective growth in Wind, with a focus on the Onshore business.

We are seeing positive signs of a turnaround with further confirmation in the recent 1Q24 print. Onshore wind is in the midst of a $2bn EBITDA swing from 2022 to 2024 as the company completes low-margin backlogs and delivers higher-margin ones (similar to Electrification). Signs of weakness are largely attributable to the challenged Offshore wind business which continues to deliver poor margin orders.

Investor day 2024:

“So in summary, our Onshore turnaround is succeeding. We have more than -- we're more than halfway through our $2 billion EBITDA swing from 2022 to 2024.”

“The backlog was really pre-COVID, pre-inflation and that's a book of business”

I believe the main debate regarding the Wind business revolves around wind energy’s attractiveness relative to other technologies. After all, with solar LCOE significantly lower relative to wind, why not just build solar? My view is that not all markets are suited for solar due either to topography (uneven grounds, or limited land area), weather (cloudy climates), or simply the lack of sunlight at night thus requiring the supplement of expensive battery storage which significantly increases the LCOE. Nonetheless, solar represents the biggest risk to the segment and is something to keep an eye on.

Management team

Finally, I’d like to touch a little on the management team. GEV is helmed by Scott Strazik, a long-time GE executive who experienced the highs and lows of the business. Scott was chosen to turn around the GE Power business after Jeff Immelt was booted in 2017. He took over the reins in GE Power (at its trough in 2017) and he is currently only 45 years old. The fact that he wants to be there for 20-30 years and turn GEV into a 12-figure market cap business is simply a stamp of approval of his dedication — and we are seeing healthy signs.

Competition seems like the main worry for now; believe it is not a pressing issue (yet)

Concerns regarding Wind and Electrification growth mainly revolve around competition:

Wind: Some bears think that price wars and intense competition will continue with ASPs in China being ~20% lower than Western peers. While it is difficult to envision a world where the West can reach parity with China (due to manufacturing scale and cost of labor), I believe that the combination of government subsidies (IRA, Green Deal etc.), import tariffs and logistics costs combined would substantially lower that cost premium. Perhaps most important is the emphasis on reliability — developers are not willing to risk malfunctions just to shave a few percentage points on equipment costs. In fact, banks award lower costs of capital for developers who use reputable and reliable components.

Electrification: GEV competes with industrial conglomerates globally (Eaton, Schneider, ABB, Hitachi) in a highly competitive arena. There’s no denying that competition is heating up (e.g., Hitachi recently made $1.5bn investment in HVDC technology), though demand seems to outweigh supply at the moment. I do think near-term risks are low given that GEV already has DD margin orders in its backlog.

Financials and valuation

Now that we’ve explored the narrative, let’s talk numbers. I will largely base my assumptions on management’s 2028 guidance and IEA’s growth forecasts in the base case. The stock has enjoyed a decent rally since I commenced my research as selling pressure by GE Aero investors has begun to ease after a solid 1Q print. Nevertheless, I still think the stock has significant long-term upside potential.

Overall, the management expects to grow revenue at MSD, achieve 10% adj. EBITDA margin and 90-110% net income-FCF conversion by 2028. I think this is highly achievable before 2028. Below are my assumptions:

Power is a $17.4bn revenue business making 10% EBITDA margin in 2023. I expect Power to grow MSD through 2028 with ~100bps margin expansion annually based on the following assumptions:

Gas: IEA expects the gas industry’s generation capacity to be flattish through 2030 as we continue our energy transition towards renewables. However, GEV’s dominant market share should support GDP+ growth through 2028 with the energy crisis impact and coal-to-gas transition adding LSD points in the near term.

Nuclear: IEA expects nuclear to grow at ~3-4% CAGR through 2030. I believe this is likely too conservative — nuclear should see MSD growth as appreciation for the technology and more localized power generation continue to increase, though this is likely back-weighted. Nuclear should grow from MSD in the early years to HSD in the out years.

Steam: This segment should be flattish and stable as growth in the nuclear portfolio offsets the decline in the coal portfolio. I am expecting GDP- growth here.

Hydro: IEA forecasts 1.5% CAGR through 2028. I don’t think this is GEV’s focus considering the lack of mentions relative to other technologies during the investor day. I am forecasting growth in line with GDP.

Margin expansion will likely come from better operational efficiency given the focus on lean and pricing support given GEV’s dominant market share. GEV will also likely enjoy price-cost tailwinds when nuclear adoption eventually takes off in the mid-term. I expect GEV to achieve their LDD long-term margin guide comfortably.

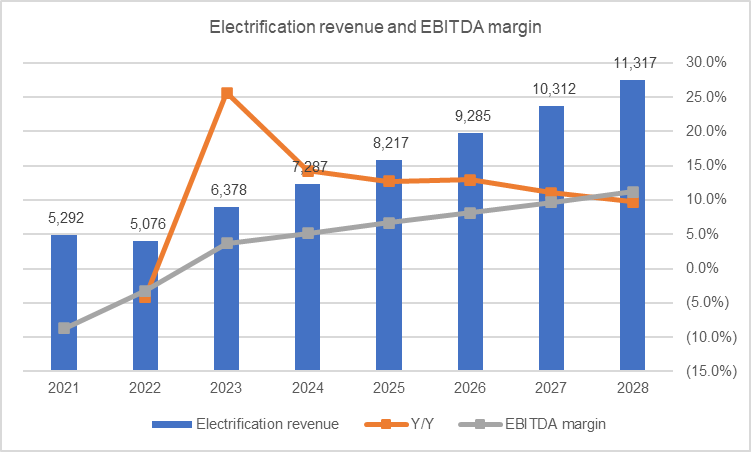

Electrification has the greatest upside and we are seeing good progress from 1Q24 earnings. I believe is well-positioned to ride the multi-year supercycle in electrification demand moving forward due to its competitive product offerings

Grid Solutions is the main driver and will continue to see robust growth as demand for grid upgrades and broader electrification gains steam, especially for HVDC. GEV printed 21% organic y/y growth in 1Q24 and I think this sets the stage for high teens growth in the near term, fading to mid and low-teens growth in the out years.

Electrification Software should also see robust growth linked to grid solutions and an overall emphasis on intelligence. The management has said that it plans to make this a best-in-class business in line with the Rule of 40. I am forecasting HSD growth CAGR through 2028 for now given the lack of disclosures, but feel like this might be slightly conservative.

Margins should also see healthy expansion as GEV moves on to execute on high margin orders already in the backlog. Given that peers are making significantly higher margins relative to GEV now highlights the amount of headroom left for GEV. I am forecasting low-teens margin in 2028.

Wind has been a poor business but we are seeing that turnaround. Onshore wind has been profitable for the last 3 quarters and is expected to do HSD EBITDA margin in 2024, while management is expecting the total wind segment to be breakeven in 2024 as the company delivers on very unprofitable offshore wind turbines which should come to an end by end 2025 to early 2026.

Onshore wind is seeing significant signs of turnaround as mentioned earlier. IEA expects wind power to grow 11% CAGR through 2028 but I believe it is likely back-weighted as the industry recovers from higher rates and a historically poor business environment. Therefore, I am forecasting HSD revenue growth CAGR through 2028 (slightly below IEA forecasts) and low teens EBITDA margin in 2028.

Meanwhile, offshore continues to be challenged with poor margin orders and the poor macro is not helping. While GEV has mentioned that it still wishes to pursue focused growth in Offshore, I will assume GEV eventually exits the business in 2027 in my base case.

LM Wind is not a key focus or driver and I am assuming it grows with inflation with a 5% margin.

I would highlight that GEV’s business is highly cash-generative and requires little cash to fund working capital. Current contract liabilities make up 33% of its liabilities and equity while contract assets make up 18% of assets. If we extrapolate this in line with revenue growth and assume status quo, changes in working capital will significantly decrease, thereby supporting the 90-110% FCF conversion that the management aims to achieve by 2028.

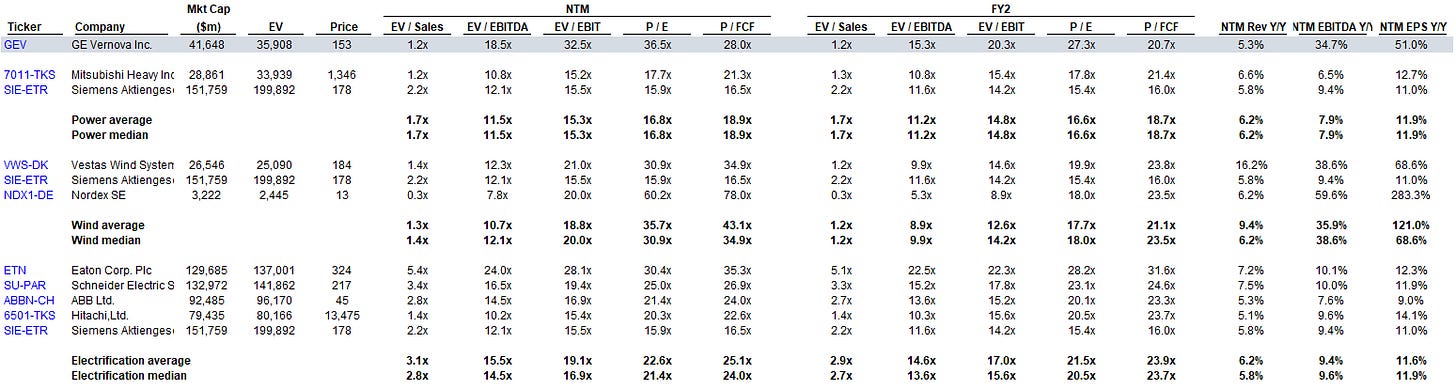

GEV currently trades at 36x NTM PE / 14x NTM EV/EBITDA and I believe it is undemanding. Here’s how I would frame the SOTP valuation based on the above assumptions and peer comps:

Power should make $2.7bn adj. EBITDA in 2028 and trade at 13x (slightly above peer) which is entirely reasonable given the growth rate, margins and pole position globally. This implies $35.4bn EV.

Wind should make $1.3bn adj. EBITDA in 2028 and I think it deserves a 10x multiple (~15% below global peers), this implies $13bn EV.

Electrification should make $1.1bn adj. EBITDA in 2028 and trade at 12x. I think this multiple is reasonable considering (1) growth outpaces peers, and (2) significant margin upside potential. This implies $13.5bn EV.

If we further split Electrification Software ($1.3bn in 2028) and benchmark it to software names, it could be worth $6.5bn on its own should it trade at 5x sales.

The business should generate ~$5.0bn FCF by 2028. Assuming no dividends or buybacks, that would imply $14.6bn cash pile in 2027. This implies a $290 stock price in EOY 2027 (19% IRR).

I believe these assumptions are borderline conservative. GEV has made it clear that they plan to achieve their long-term business targets by 2028 (they could likely achieve them early which could make the stock moon).

Main downside risks now are (1) persistent weakness in Wind and (2) competition in Electrification (and Wind). Assuming the worst, I assign zero value to Wind. Competition will result in muted margin expansion in Electrification though that is unlikely. This should result in Power / Wind / Electrification trading at 10x / 8x / 10x respectively (bottom range based on comps). This equates to a $116 stock by EOY 2024, or 24% downside from the current $153 stock price (GEV at $122 just 3 weeks ago was a no brainer).

In all, I believe GEV offers investors with a unique opportunity to invest in a leveraged proxy of an amalgamation of the largest themes we are seeing today; and is the perfect asset for many LO managers / SWFs (like Temasek).

Disclaimer: All views expressed are the sole opinion of the author and should not be interpreted as investment advice. All readers should conduct independent research before making any investment decisions.