Hitachi (6501 JP, HTHIY)

From inefficient, short-cycle conglomerate to quality, long-cycle industrial behemoth

Summary

I believe Hitachi should be a core holding for investors looking for Japan exposure as it is well-positioned to grow profits by (1) leveraging robust end market demand in the electrification and structurally greater IT spending in Japan, (2) while being supported by a growing Lumada ecosystem. In all, I see a path for revenue compounding 8% CAGR through FY27 largely driven by GEM and DSS, and margins expanding 270bps to 12.1% in FY27, supporting JPY 1.5tn in adj. EBITA. Valuing the stock on a SOTP basis implies a JPY 4,600 by Mar 2026 (27% upside, 16% IRR). This PT implies a 14x NTM EBITDA / 21x NTM PE multiple which I believe is reasonable considering its improving business quality and higher profitability.

*Note: Hitachi has rallied significantly after the unwind, and IRR has been declining since I started writing this. For those who caught the rebound, congratulations. For those who are not comfortable with the current IRR, I hope this post still serves its purpose as a brief primer that sets the stage for future opportunities for the stock.

Introduction

Hitachi has been a monster of a stock since the beginning of 2023 as investors’ focus shifted to its power grid segment which has been enjoying tremendous growth momentum amid a strong demand environment globally. Despite the massive rally, I believe Hitachi still offers investors decent risk/reward. The stock rebounded quickly after the recent unwind in the Japanese market, but I believe this is still a golden opportunity for new investors to build a new position on the name.

This post is going to be a rather long one given the many business segments, but will aim to serve as a brief primer on the company and provide an opinion on valuation. I will skip detailed elaborations on the company’s history and will mainly focus on the company’s key earnings drivers moving forward.

Business description

Conglomerates are notoriously difficult to analyze given their many business segments. Hitachi is no exception, making it difficult to isolate earnings drivers. However, in light of Japan’s corporate governance reforms and its restructuring initiative, the company has now streamlined its business into three main segments. At its core, Hitachi is a capital goods and IoT company.

Digital Systems & Solutions (DSS), 29% of consolidated sales / 32% of total adj. EBITA (13% margin as of FY23): this segment is essentially the IT / IoT / IT service segment. It sells hardware, software and IT consulting services mainly to enterprise customers. It is primarily a system integrator (SI) business that helps other companies digitalize. It further reports three sub-segments as follows:

Front Business: customized IT solutions for various industries (FIGs, manufacturing, government organizations, healthcare etc.).

IT Services (ITS): IT consulting business (think Accenture $ACN, Gartner $IT).

Systems & Platforms (SP): software offerings (including digital engineering, data analytics, cloud services etc.) and hardware (IT products like storage servers etc.).

Green Energy & Mobility (GEM), 40% of consolidated sales / 35% of adj. EBITA (6% margin as of FY23): this segment is the most relevant to the company’s near future as it is seeing the greatest business momentum. It includes the following sub-segments:

Nuclear & Hitachi Power Solutions: manufactures and sells nuclear reactors (and fuel), and provides maintenance and decommissioning services through a JV with GE. HPS mainly sells power generation systems used during emergencies. This sub-segment still makes up a small proportion of revenue and is not the main focus, though it represents a call option on the burgeoning nuclear narrative in Japan and globally.

Hitachi Energy (HE): manufactures and sells electrical infrastructure used in transmission and distribution (T&D). It is the global leader, ahead of Siemens Energy and GE Vernova GEV 0.00%↑. This is where investors are most focused on right now in light of an inflection in grid investments globally due to rapid electrification.

Railway Systems (RS): manufactures locomotives and provides maintenance services, alongside rail signaling software. This segment plays into the long-term decarbonization and connectivity theme globally.

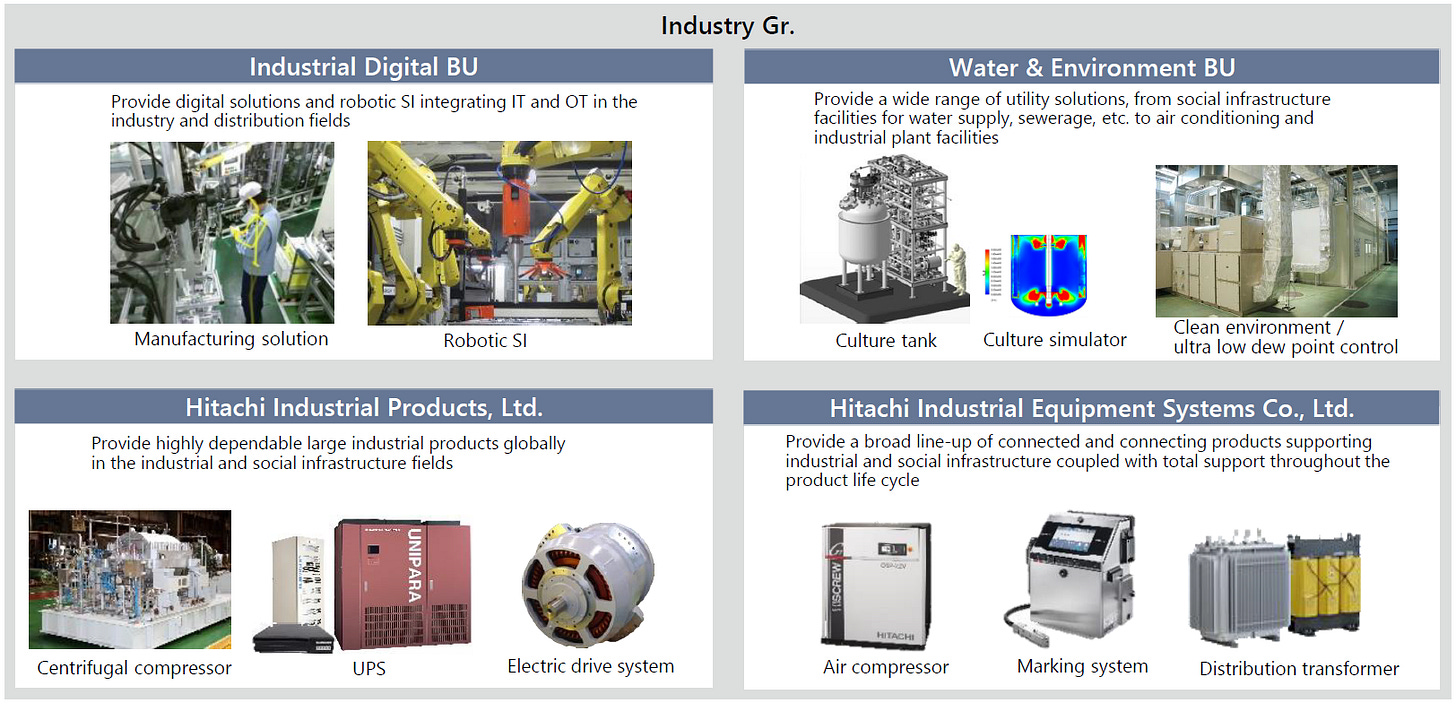

Connective Industries (CI), 32% of consolidated revenues / 33% of total adj. EBITA (10% margin as of FY23): this segment includes a combination of various other businesses which sell industrial products globally. This is the more cyclical component of the business given its shorter-cycle end markets. Given the many moving parts, I will skip the details and provide you with a visual representation of the sub-segments.

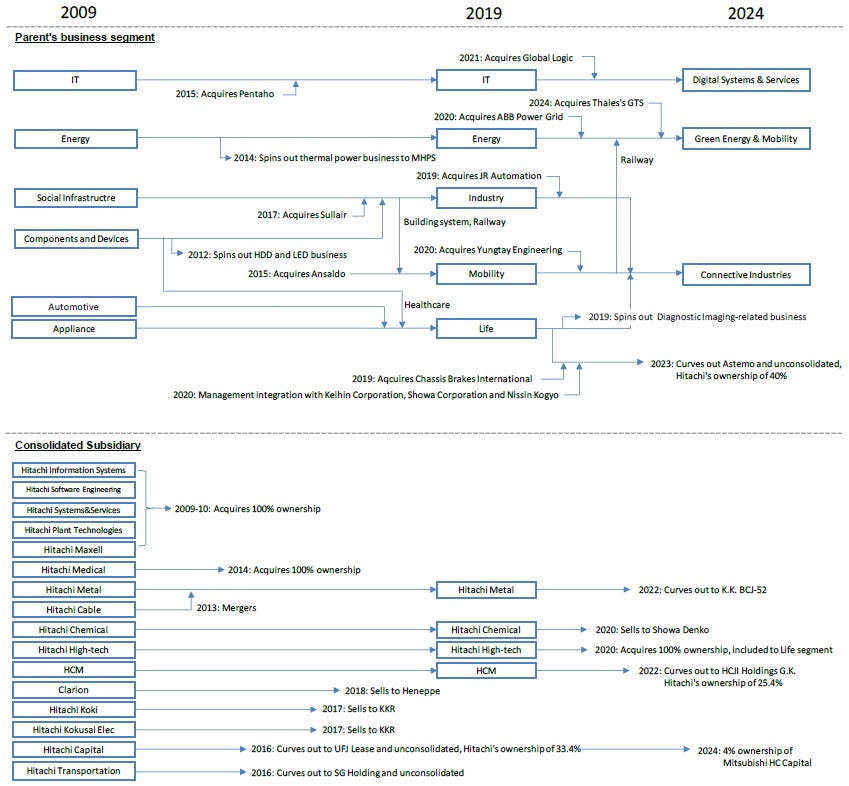

Great conglomerates are often ones that get rid of excess baggage and have 2-3 key business drivers. To better appreciate Hitachi, it is worth mentioning its restructuring initiative. Hitachi was once a more complex business with inefficient capital allocation across many segments. After profits hit rock bottom during the GFC, the company initiated a major restructuring plan which has since significantly improved profitability, cash flow generation and ROE. Main divestments in recent years include Hitachi Construction Machinery (HCM), Hitachi Metals, Hitachi Astemo (automotive powertrains, chassis, systems etc.) and Johnson Controls-Hitachi Air Conditioning (JV).

Next phase of profitable growth

By getting rid of its underperforming highly cyclical businesses, Hitachi has transformed from a short-cycle industrial conglomerate to a long-cycle industrial behemoth. Hitachi has now entered the fourth stage of restructuring which allows it to achieve long-term structural growth in its digital and green businesses.

The thesis on Hitachi is simple: Hitachi is well-positioned to significantly grow profits across all three business segments by leveraging accelerating end-market demand, supported by Lumada. We explore key earnings drivers in each segment below. But first, we have to understand what Lumada is.

Lumada — driving synergies across the entire business

Lumada played a pivotal role in facilitating this business transformation. Simply put, Lumada is an ecosystem that combines all the strengths of Hitachi’s individual businesses. It is the ecosystem that combines the best of Hitachi’s operational technologies (hardware) and information technologies (software). Think of this a little bit like the Apple ecosystem but on an industrial scale. On the organizational level, Lumada is the philosophy that unifies the Hitachi group and prevents individual business silos (which was often the case for conglomerates including Mitsubishi Electric, more on this in a future post). Here is a video which I think best explains what Lumada is.

Perhaps this is best illustrated using an example. Imagine a utility company that wishes to build a new transmission line. It would first have to conduct some form of digital engineering to plan the buildout (GlobalLogic under DSS). Second, they would purchase the heavy electrical infrastructure products from Hitachi Energy (under GEM). Of course, this includes software solutions which allow the utility to operate, monitor and detect failures in the system. Finally, Hitachi also offers maintenance and repair services for their products. In this case, Lumada is the intelligent system that combines data from Hitachi’s grid products to generate insights to prognosticate a failure/outage so the utility can schedule repair works to minimize downtime. Hitachi’s website provides many more examples.

It is important to understand what Lumada is because (1) it facilitates upselling and cross-selling within Hitachi’s many businesses thereby boosting growth; and (2) improves profitability because the inherent stickiness of the business model allows Hitachi to contract long-tail service revenues. It also improves profitability as the time spent developing subsequent customized solutions is significantly reduced as each completed project is a useful precedent for subsequent ones. Lumada's sales ratio has increased from 13.7% in FY1Q21 to 27.0% in the latest quarter, while adj. EBITA margin increased from 4.4% to 11.0%. While the improved profitability is also a function of favorable tailwinds in certain sub-segments, I believe Lumada has played a pivotal role in driving this transformation.

Next, we dive deeper into the different segments and explore how Lumada ties into each of them.

DSS — GlobalLogic and Lumada to fuel the next leg of growth

DSS represents the core of Hitachi’s legacy IT business. It has a few moving parts but it can be generally thought of as a system integrator (SI) business. Revenues are predominantly generated in Japan (67% of revenue), followed by North America (13%), Europe and China (9% each). However, this geographic mix has started to shift with the acquisition of GlobalLogic, a US-based digital engineering software company.

Growth in DSS has been rather cyclical in the past largely because (1) Japanese companies were slow to digitalize their businesses and (2) FX impacts. Relative to their peers in other developed markets, Japanese companies have significantly underinvested in technology and software prior to Covid which was a strong wake-up call which spurred increased investments. Meanwhile, the Japanese government has also flagged the digital trade deficit between Japanese companies and foreign Big Tech as a pressing issue and is actively encouraging greater investments in technology through policy support.

A common high-level data point to track would be the BoJ’s quarterly Tankan survey which paints a similar picture — Japanese corporates (especially the largest enterprises) are now investing more in software than ever before. I expect this trend to continue in the long term as Japanese corporates attempt to narrow the $34bn digital trade deficit and massive investment gap with their Western peers. As one of the largest domestic IT companies in Japan, Hitachi certainly stands to benefit.

Given the multiple moving parts, I will only focus on the most notable product in Hitachi’s DSS business: GlobalLogic.

GlobalLogic — expanding IT suite and supercharging growth overseas

Hitachi acquired GlobalLogic in Jul 2021 to expand its suite of solutions and supercharge growth overseas. GlobalLogic is essentially a software engineering services company, similar to an SI but with a key focus on the software development portion. This particularly complements Hitachi as it has traditionally lagged behind its peers in the software field due to its hardware-centric mindset stemming from its expertise in providing world-class hardware solutions (servers). Moving forward, I believe GlobalLogic provides two sources of value for Hitachi.

First, it accelerates overseas growth in the DSS segment. DSS has traditionally been tailored towards complex projects for large enterprises with long project schedules, which was in contrast to the overseas market where problems were more dynamic and diverse. GlobalLogic is a US-based company with a blue-chip customer base (Samsung, BMW, Qualcomm etc.) which serves as an important testimony to the value it can bring to large corporations. I believe the inherently sticky nature of the business lowers the barrier to adopting other Hitachi IT solutions, thereby accelerating DSS growth and onboarding them into the Lumada ecosystem.

This also brings me to the second point: I foresee it generating significant synergies with Lumada and other business segments in the long term (as illustrated in the Lumada example above). While GlobalLogic only makes up ~10%+ of DSS revenue today, it is already adding 1-2% to headline DSS growth. At the same time, other business segments are also sustaining GlobalLogic growth as evidenced by its superior growth rates relative to its peers like EPAM EPAM 0.00%↑. Additionally, we already see promising signs of synergies generated across different segments: management has noted that the number of synergy projects currently underway has more than doubled from 59 in April 2023 to 129 in March 2024, and GlobalLogic has been participating in a variety of projects in the operational technology (OT) domain including energy, railway, semiconductor manufacturing, and biopharmaceutical projects.

Moving forward, I expect GlobalLogic to continue growing >20% CAGR through FY27, thereby supporting low-teens DSS CAGR over the same period and ~250bps of margin expansion from 12.9% in FY24 to 15.4% in FY27.

GEM — a global electrification renaissance + long-term decarbonization

GEM is the most attractive segment and the biggest earnings driver moving forward due to the explosive growth in HE (power grid business). Hitachi acquired the business from ABB back in 2020 (announced in Dec 2018, completed in Jul 2020) and has enjoyed tremendous growth since due to robust demand amid a global electrification renaissance. I will skip the lengthy elaboration here as I have previously expanded on this in my posts on GEV and Siemens Energy and the thesis is similar. In essence, I believe Hitachi Energy is well-positioned to grow profits by leveraging robust demand amidst a global electrification renaissance. I am forecasting 21% CAGR growth in HE through FY27 with margins expanding 120bps from 9.0% in FY24 to 10.2% in FY27 (a little conservative here due to FX but I believe there is upside to this given the strength of tailwinds).

Railway Systems — now on a level playing field with Siemens

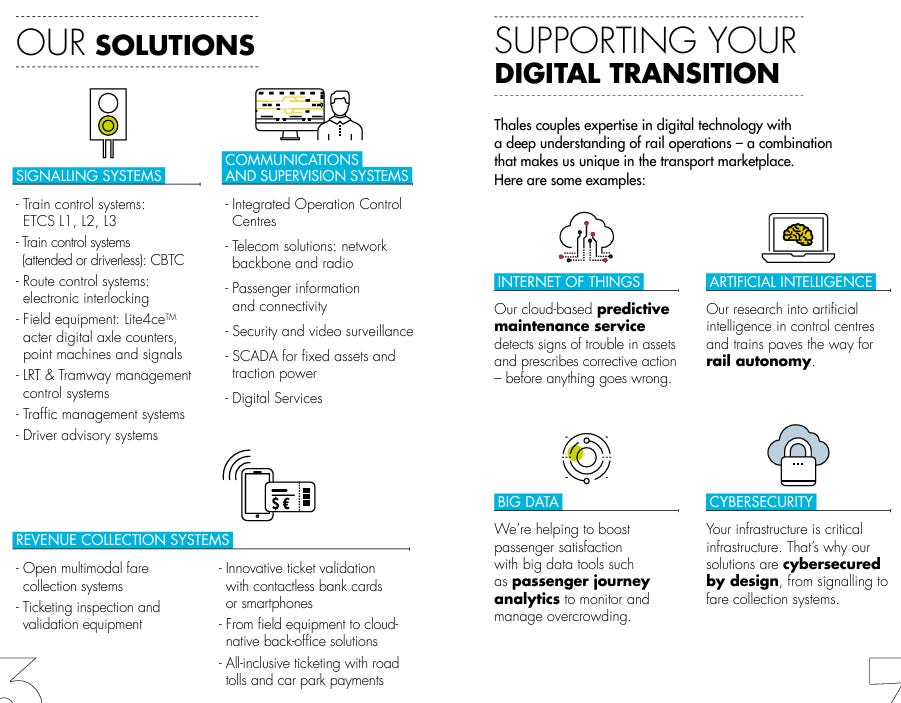

Hitachi Rail (HR) manufactures rolling stock and provides mission-critical rail signaling software globally. It is the #4 / #5 player globally and mainly competes with other locomotive OEMs and software providers such as Alstom and Siemens Mobility in a generally oligopolistic market. Similar to HE, the majority of revenues are generated overseas. The key area to focus on is the recent acquisition of Thales Ground Transportation System (GTS).

Thales GTS is a ~EUR 1.7bn+ business that mainly provides rail signaling software solutions (the brain behind railway lines which ensures safe and efficient train movement) to over 100 metro lines globally (mainly in Europe). There is a high chance that your daily commute is managed by Thales GTS. I view the acquisition as a huge positive for Hitachi for several reasons.

First, this acquisition will now place Hitachi on a level playing field with its European peers in terms of scale which significantly increases Hitachi’s competitiveness in the global market. HR is now a EUR 7.3bn business (vs Siemens Mobility and Alstom make EUR 11bn and EUR 17bn revenue respectively).

Second, there is now a clear path to improved profitability at HR in line with its competitors — Siemens Mobility and Alstom generate 8-9% and 6-7% adj. EBITA margins respectively. Before the acquisition, lower-margin rolling stock made up 60-70% of revenue, while higher-margin rail control software accounted for the remaining. The acquisition of Thales GTS has altered this mix — rail control software now accounts for 70% of order intakes compared to 51% before the acquisition. With Thales GTS generating ~11% adj. EBITA margins (vs HR which makes ~8% margin), I expect significant margin expansion in the future. Overall margin expansion on a group level should also see greater upside depending on the extent to which synergies with Lumada can be generated.

Finally, the acquisition also generates synergies with Lumada and DSS in the long-term. As rail systems become increasingly digitized and interconnected, the DSS segment can leverage data generated from operational technologies (in this case, rolling stock) to further drive operational efficiency and facilitate the proliferation of autonomy in the long-term.

In all, I am forecasting 17% CAGR growth in HR through FY27 with margins expanding 120bps from 7.7% in FY24 to 8.9% in FY27.

Nuclear — a long-term call option

Hitachi also operates a nuclear business GE Hitachi Nuclear Energy — a JV between GE GE 0.00%↑ and Hitachi which manufactures small modular reactors (SMR) and nuclear fuel. While it only makes up ~10% of GEM (~3% of total revenue), I view this as a long-term valuable call option on the burgeoning nuclear narrative in Japan.

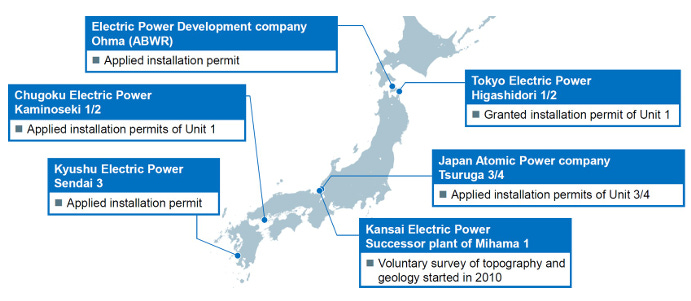

Nuclear power has recently regained popularity after hyperscalers purchased nuclear capacity to power their AI data centers due to its efficiency and stable baseload generation. Meanwhile, Japan is pushing for a revitalization of its nuclear plants amid growing demand and a push for greater energy security.

The Japanese nuclear industry is a triopoly between Mitsubishi Heavy Industries (MHI), Hitachi and Toshiba; MHI is still the leader having constructed all 24 PWRs in Japan since the 1970s.

Hitachi reported ~1.5x growth in order intake in the nuclear sub-segment as a result of a massive order. There are still limited expectations that this business will take off in the near-term given the lack of clear direction from the Japanese government, but could very well be a key driver for the group in future.

In all, I am forecasting 18% CAGR growth in GEM through FY27 with margins expanding 400bps+ from 6.3% in FY24 to 10.4% in FY27 largely driven by robust demand in HE and a mix shift to higher margin software in HR.

CI — more cyclical but long-term growth supported by Lumada

CI is the most cyclical portion of the broader business given its exposure to shorter-cycle industrial end markets. There are many moving parts but the main sub-segments to focus on are Building Systems, High-Tech, and Industrial Products since they make up the majority of revenue and profits. Intuitively, each sub-segment has its end market and goes through different cycles: CI is correlated to real estate activity (especially in China); High-Tech is correlated to semiconductor production; Industrial Products is correlated to overall industrial activity. The main thesis here is (1) the substantial improvement in profitability driven by Lumada and (2) continued restructuring efforts.

First, Hitachi has the potential to continue increasing the software content in customers’ wallets driven by synergies with GlobalLogic and Lumada, hence improving overall profitability for the segment. Customers (especially existing ones) are naturally incentivized to continue using Hitachi’s OT products and stick within the Hitachi ecosystem. We are already seeing promising signs of improved profitability. For example, Building Systems margin has improved considerably from 8.5% in FY22 to 10.5% in FY24.

Second, Hitachi continues to streamline the business which will likely result in further cost savings, ROE / ROIC improvements and improved balance sheet health. Hitachi recently announced its full divestiture of its stake in the air conditioning (AC) JV to Johnson Controls JCI 0.00%↑ for JPY 195bn. The market views this favorably as it is margin dilutive (8-9% vs 10%+ margin for CI). Meanwhile, the company mentioned that it will acquire the Shimizu factory which will serve as a development and manufacturing base for commercial HVAC for the data center market. While I don’t see this as optimal (because they lack the expertise and scale to compete in the intensifying DC cooling market), it could also potentially be a future growth driver given the rapid buildout of DCs in Japan at the moment.

Furthermore, there are still pockets of opportunities for further restructuring such as the Water & Environment business which sells social infrastructure products. These businesses hardly move the needle and see little synergies with Hitachi’s other businesses. While the company has not explicitly indicated that such restructuring efforts are in the pipeline, I see such announcements as a critical upside catalyst for the stock in future.

Valuation

Hitachi has rerated significantly since late 2022 amid greater investor focus and appreciation for the stock. It now trades at ~12x NTM EV/EBITDA, which represents a slight premium to Siemens. While the 80% rally YTD might deter new investors, I believe Hitachi still trades at a reasonable valuation if we value this on an SOTP basis, and offer investors decent risk/reward for their investment. My assumptions are as follows:

DSS: I expect DSS to grow 11% CAGR through FY27 supported by heightened IT spending by Japanese firms and GlobalLogic. In the longer term, I foresee GlobalLogic and Lumada synergies adding 2-3% of growth up from 1-2% today. I believe this is reasonable as Hitachi is a leader in an industry that is growing at teens CAGR. Adj. EBITA margins should improve ~250bps to 15.4% in FY27 largely driven by Lumada, supporting JPY 550 adj. EBITA by FY27.

GEM: revenue should grow 18% CAGR through FY27 as Hitachi enjoys robust end market demand in HE and stable growth in HR. I am modeling stable MSD growth in nuclear in the base case, with potential upside in the mid-term should Japan accelerate its nuclear plans. Adj. EBITA margins should inflect significantly on the back of strong price tailwinds in HE and the shift towards a software-weighted mix to achieve 10.4%, supporting JPY 530bn adj. EBITA by FY27.

CI: given the uncertainty in end market demand in the respective end markets (especially in the BS), I am forecasting a modest GDP+ (~5% CAGR) growth in CI. Meanwhile, synergies with Lumada and further operational improvements should support slight margin expansion to 11%, supporting JPY 400bn adj. EBITA by 2027.

I value Hitachi on a SOTP basis using NTM EV/EBITDA multiples given the substantial amount of acquisition-related amortization the company recognizes. After taking into consideration the respective comps and adding back Hitachi’s minority stake in Hitachi Construction Machinery (assuming value of JPY 200bn which implies flat market cap) and Astemo (assuming value of JPY 230bn based on transaction price), Hitachi could be worth JPY 4,600 per share by Mar 2026 (27% upside, 16% IRR). Using a DCF as a sense check with 13% WACC and 7% terminal growth rate implies a similar PT of JPY 4,700.

Given that profits are relatively evenly split across the three segments, there are multiple risk cases which can result in slower profit growth. However, given investors’ exuberance in HE and DSS, I believe the main risk case is that we see a sharp slowdown in HE (due to capacity constraints) or DSS (due to increased competition). I am modeling low teens CAGR in HE and HSD CAGR in DSS, and limited margin upside for the overall business (150bps improvement through FY27 to 11%). Assuming 1-2 turns below base case multiples implies a JPY 3,000 stock (~19% downside).

FX is a risk but I believe not a pressing one as Hitachi is not as susceptible to FX fluctuations as compared to other Japanese industrials due to its localized production facilities. Sell-side estimates that FX sensitivity is ~0.4% for every 1% change in JPY.

In conclusion, I believe Hitachi should be a core position for any investor looking for Japan exposure given its improving business quality as a result of robust end market demand and continued restructuring initiatives.

Disclaimer: All views expressed are the sole opinion of the author and should not be interpreted as investment advice. All readers should conduct independent research before making any investment decisions.